To get out of debt fast without a higher income, strategically pay off high-interest debts, cut expenses ruthlessly, negotiate with creditors for better terms, use smart consolidation, and generate short-term cash through selling items or micro-gigs, all guided by a clear action plan.

Does trying to pay off debt feel like running uphill with a backpack full of stones? Many of us know that heavy, tiring sensation: payments come in, interest piles up, and progress seems tiny. I’ve watched people trade one emergency for another while hoping for a bigger paycheck to fix everything.

Recent estimates suggest roughly 40% of households carry high-interest consumer debt, and that burden can sap months of take-home pay. That’s why How to Get Out of Debt Fast Without a Higher Income matters: it’s not about waiting for luck, it’s about using strategy. Small shifts in priorities and negotiation can free more cash than most people expect.

Too many guides push vague advice—”cut coffee” or “get a side hustle”—without showing how to prioritize debts, talk to creditors, or stop leaks in your budget. Quick fixes often trade short-term relief for longer-term cost, leaving the root problem untouched.

In this guide I’ll walk you through a practical, evidence-minded plan: how to map every debt, choose a repayment method that fits your psychology, negotiate real concessions, free up cash fast, and use safe consolidation when it helps. Expect specific scripts, checklists, and a 90-day action plan you can start this week.

Assess your debts and set a clear baseline

Feeling lost under a stack of statements? Start here: a clear baseline turns chaos into a plan. I’ll keep this simple so you can act today.

Make a complete list of every debt and creditor

List every debt and include creditor, balance, interest rate, and minimum payment. This is your inventory.

Begin with credit cards, personal loans, student loans, auto loans, medical bills and any payday or store debt. Put the creditor name, current balance and the exact minimum due on each line.

Example: a credit card with $20,000 balance at a high APR may have a $600 minimum. Seeing numbers side by side changes decisions.

Calculate interest rates, minimums, and total monthly burden

Total monthly burden is the sum of all minimum payments and expected interest. Add every minimum payment to get this number.

Also note the APR for each account. Many cards charge > 18% APR, which makes balances grow if you pay only minimums. Use a simple formula or online calculator to estimate monthly interest.

Practical tip: write the APR next to each balance so you can spot the costliest debts at a glance.

Identify monthly cash flow and discretionary spending

Monthly cash flow equals take-home pay minus fixed essentials. Track all income, then list rent/mortgage, utilities, groceries and transport.

Next, list subscriptions, dining out, and shopping as discretionary items. These are areas you can free cash quickly for debt payments.

Quick check: if income is $3,500 and essentials are $2,500, your potential pool for extra payments is $1,000 before discretionary cuts.

Create a simple debt dashboard (spreadsheet or app)

Debt dashboard is a one-page tracker showing balances, APRs, minimums and a column for extra payments. Use Google Sheets, Excel, or templates from Vertex42.

Set columns for starting balance, current balance, APR, minimum, and notes. Add a progress column that shows the percentage paid. Color-code the highest APR debts to prioritize.

Example tools: Vertex42 templates or a free Google Sheet can generate a payoff timeline and help you see how small extra payments speed up progress.

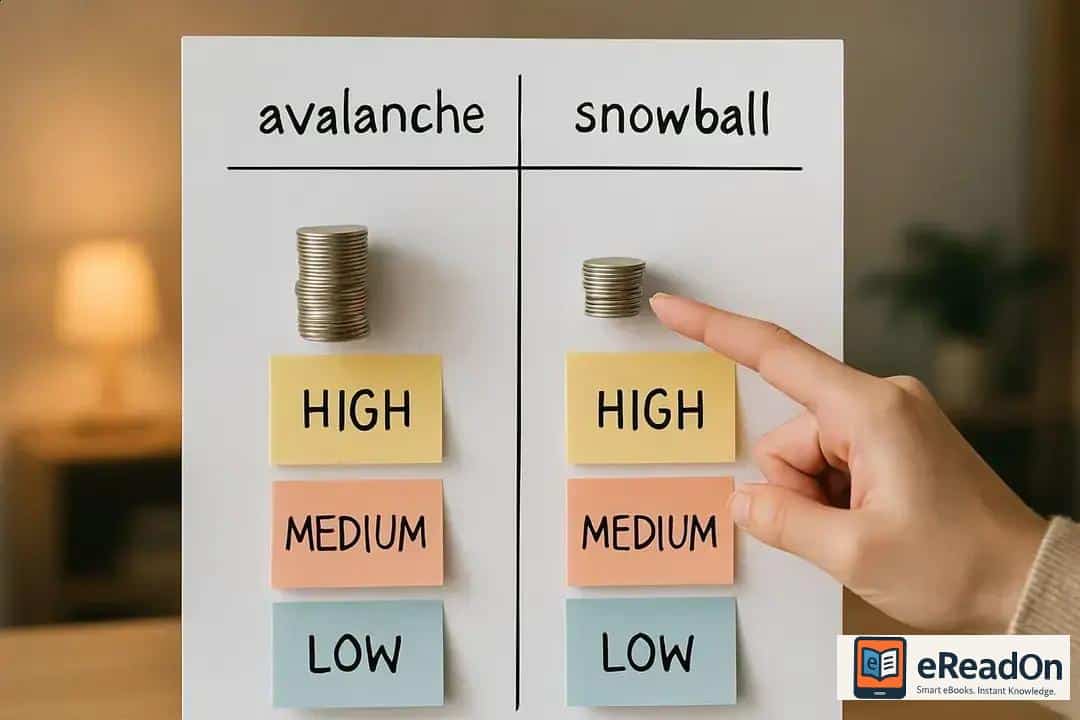

Pick the repayment method that fits you (avalanche vs snowball)

Choosing a repayment plan is less about right or wrong and more about what you’ll stick with. Below I explain the math and the psychology so you can pick a method that fits your habits and goals.

How the avalanche method saves interest over time

Save more interest by paying extra on the debt with the highest APR first. This reduces the amount of interest that accrues each month.

Numerical examples show real impact. In one scenario, putting $300 extra monthly saved about $1,341 in interest and cut payoff time by a month compared to the other method.

Use your dashboard to sort debts by APR. If you have cards at 18% or higher, avalanche usually wins for pure math.

How the snowball method boosts motivation early

Quick wins come from paying off the smallest balance first. Those early payoffs give momentum and make the plan feel real.

Imagine clearing a $500 account in two months. That small victory can keep you consistent, which many experts say matters more than the theoretical savings if you might quit.

Snowball often costs more in interest overall, but it helps people stay on track.

When a hybrid approach makes sense

Hybrid approach uses snowball for two or three tiny balances, then switches to avalanche for the high-rate debts. It blends motivation with efficiency.

I suggest this when you need quick wins to build habit but also want to avoid paying too much interest long term. Many people find the hybrid easier to stick with.

Short worksheet to choose the right method for you

Payoff worksheet: list debts with balance and APR, then simulate two plans for a month: extras to smallest vs extras to highest APR. Compare interest and emotional fit.

Step 1: write each debt, balance, APR, and minimum. Step 2: pick an extra payment amount. Step 3: project one month of interest saved for both methods. Step 4: choose the plan you can follow for 90 days.

Small tests beat indecision. Try one method for a month and adjust if it feels wrong.

Negotiate with creditors: scripts and realistic goals

Talking to creditors can feel awkward, but a clear script and realistic ask lets you win. Prepare proof, offer what you can pay, and get every agreement in writing.

Prepare documentation and realistic proposals

Document everything: account statements, payment history, and proof of hardship. These items make your case credible.

Bring a clear proposal: the exact monthly amount you can pay and the number of months. For example, offer $150/month for 12 months rather than a vague promise.

Tip: note the agent’s name, date, and what they agreed to. If they promise a rate cut or removal of fees, ask for confirmation by email.

What to ask for: lower rate, smaller payments, settlement

Ask for lower rate to reduce ongoing interest or request smaller monthly payments to avoid default. If you have a lump sum, propose a settlement.

Settlements commonly range from 30–50% of the balance depending on the creditor and account age. Make a targeted offer you can fund within 30–60 days.

Always ask what the offer will mean for your credit report and get that promise in writing.

Sample scripts for calls and emails

Call script: “Hello, I’m calling about account X. I can pay $[amount] per month. Can we set a temporary lower payment or rate?” Pause and note the response.

Settlement script: “I can offer $[one-time amount] to settle the balance in full. Will you accept that and send written confirmation?” Follow up by email with the same numbers.

When you finish a call, say the agreement out loud and ask the rep to confirm the next steps. Then email a recap and request written confirmation.

When to escalate or seek professional help

Seek professional help if you face multiple creditors, complex disputes, or threats of legal action. A credit counselor or attorney can negotiate and protect you.

If a collector won’t validate the debt or you suspect errors, ask for a validation/verification letter and consider stopping calls until you get it.

Use pros when DIY talks stall. Their experience often gets better terms and prevents costly mistakes.

Cut spending fast: targeted budget hacks that free cash

Need cash fast to throw at your debts? Cutting spending is the quickest route. Small, targeted changes add up in weeks.

Audit recurring subscriptions and cancel ruthlessly

Cancel subscriptions you don’t use and keep only the essentials. That immediate action frees monthly cash fast.

Many people lose $50–$200 each month on forgotten streaming, apps, or memberships. Check bank statements and credit card bills for recurring charges.

Examples: pause an unused gym plan, remove duplicate streaming services, and cancel cloud storage you no longer use. I delete one subscription and move the savings straight to debt.

Trim variable expenses with concrete swaps

Concrete swaps replace pricey habits with low-cost options that still feel normal. Small swaps pile up.

Swap daily coffee out for home-brew. A $3 coffee five days a week becomes about $60/month. Pack lunches two times a week and you save another $40–$80.

Other swaps: buy generic brands, use public library for books, and carpool when possible. Each swap is a tiny victory that funds extra debt payments.

Temporary austerity checklist for 30–90 days

30–90 day sprint is a focused period where you cut nonessentials to hit a payoff goal. Treat it like a short project.

Checklist: freeze subscriptions, set a dining-out limit, pause nonessential shopping, sell one unused item, and track every expense. Make rules simple so you can follow them.

Typical results: many people free $300–$800 in a month by applying these steps. Use that cash to make a meaningful dent in balances.

Automate transfers from saved cash to debt payments

Automate transfers so savings hit debts before you see the money. Automation enforces discipline without willpower.

Set an auto-transfer the day after payday to a dedicated debt account. Use round-up tools or split direct deposit to send $50–$200 automatically.

I find automation removes temptation and keeps momentum. Even small, steady transfers speed up payoff and reduce stress.

Smart consolidation and refinancing options

Consolidation can simplify bills and lower interest, but it’s not a magic fix. You must compare offers and understand the trade-offs before you switch.

When consolidation reduces total interest vs when it doesn’t

Lower overall interest happens when the new rate plus fees is less than what you’d pay on current debts. That saves money and time.

Example: a credit card at 20% moved to a personal loan at 10% can cut interest dramatically. But if fees or a longer term wipe out savings, consolidation fails.

Key sign it won’t help: your monthly payment drops but total paid grows because the term stretched much longer.

Compare balance transfers, personal loans, credit union offers

Balance transfer cards offer 0% APR promos but usually charge a 3–5% fee. Personal loans give fixed payments and predictable payoff dates.

Credit unions often have lower rates than big banks. Shop all three: a 0% balance transfer might be best short term, while a personal loan is better for steady repayment.

Watch for fees, term length and the risk of restarting debt

Watch fees and read terms. Balance transfer fees, origination fees, and late fees can erode benefits. Also beware of stretching the term.

Longer terms can mean lower monthly payments but more total interest. A real risk is restarting debt on cleared cards. Close or freeze old accounts to avoid temptation.

Step-by-step checklist to apply and protect credit score

Protect your credit by checking your score, pre-qualifying offers, and avoiding hard pulls from many lenders at once.

Checklist: review rates and fees, calculate total cost, pre-qualify, apply to the best offer, transfer balances, and set up autopay. After consolidation, monitor your credit report for errors.

Keep paying off debt steadily. The goal is less interest and less stress, not more months of payments.

Increase short-term cash without a higher salary

You don’t need a raise to free cash quickly. With focused moves—selling stuff, short gigs, and smart use of windfalls—you can create meaningful extra payments this month.

Sell unused items and time the listings for quick sales

Sell unused items by listing high-demand things like electronics, furniture, and brand-name clothes on weekends. Price competitively for a fast sale.

Sellers report making $500+ over a weekend when they time listings for peak traffic. Tips: take good photos, write clear titles, and list in the evening or on weekends.

Bundle smaller items and offer local pickup to avoid shipping delays. Put the cash straight to debt.

Micro-gigs, freelancing, and one-week sprint ideas

Micro-gigs on platforms like Fiverr, Upwork, or TaskRabbit can pay $20–$50/hour. Short sprints like tutoring, delivery, or freelance tasks earn fast money.

Plan a one-week sprint: advertise a service, block 20 hours, and deliver results quickly. Ten hours at $30/hour nets $300, which can cover a payment or two.

Use windfalls (tax refund, bonus) with a plan

Use windfalls to make a big dent in debt. Average tax refunds can be around $3,000, so allocate them to high-interest balances first.

Decide before you get the money. Split it: pay debts, keep a small emergency buffer, and avoid impulse buys. Automate the allocation when possible.

Avoid payday loans and high-fee quick fixes

Avoid payday loans. They often charge rates above 400% APR and trap you in longer debt cycles.

Instead, use quick gigs, sell items, or ask a creditor for a short-term plan. If you must borrow, seek credit unions or small personal loans with reasonable rates.

Conclusion: your 90-day action plan

90-day action plan: In three months you can cut waste, boost payments, and lower high-rate balances. Follow the steps below and recheck progress each week.

Week 1: list every debt, note balances and APRs, and build a simple dashboard. Pick a repayment method and decide the extra amount you’ll put toward debt each month.

Weeks 2–4: negotiate with top creditors using prepared scripts. Cancel unused subscriptions and launch a one-week selling or gig sprint to raise cash. Set up automated transfers for your extra payments.

Month 2: review consolidation options if rates and fees improve your total cost. Continue cuts and sprints. Apply any windfalls directly to the highest-interest accounts.

Month 3: intensify payments on the prioritized debts and track reductions. Celebrate small wins and adjust the plan if a method isn’t sticking.

By the end of 90 days, many people free $300–$800 in monthly cash through cuts and side work. Keep automating and you’ll see interest drop and balances fall faster.

Final rule: Review and adjust every week. Small, steady progress beats occasional big moves. I recommend repeating another 90-day cycle with updated targets until the debt is gone.

Key Takeaways

Unlock the strategic path to eliminating debt quickly, even without a higher income, by focusing on these actionable steps:

- Map All Debts: Create a clear dashboard of every debt, interest rate, and minimum payment to understand your total monthly burden and direct your strategy.

- Pick Your Payoff Strategy: Select either the Debt Avalanche (for maximum interest savings) or Debt Snowball (for motivational quick wins) based on your financial personality.

- Negotiate Creditor Terms: Prepare to ask for lower rates, reduced payments, or settlement offers (often 30-50% of balance), ensuring all agreements are in writing.

- Aggressively Cut Spending: Cancel unused subscriptions (saving $50-$200 monthly) and implement concrete swaps for variable expenses to immediately free up cash for payments.

- Smartly Consolidate Debt: Only pursue balance transfers or personal loans if the new overall interest rate is genuinely lower after accounting for all fees and avoiding extended terms.

- Generate Quick Cash: Sell unused items (can yield $500+ a weekend) and engage in micro-gigs ($20-$50/hour) to create immediate funds for accelerating debt payments.

- Automate Debt Payments: Set up automatic transfers of extra cash directly to your debts; this ensures consistent progress and removes the need for constant willpower.

- Avoid Costly Loans: Never resort to payday loans or other high-fee quick fixes (often 400% APR), as these traps escalate debt and undermine long-term progress.

True financial freedom comes from consistent, informed action and a disciplined approach to managing your money, proving you don’t need more income to escape debt.

Frequently Asked Questions About Debt-Free Living

What are the main debt repayment strategies without increasing income?

The primary strategies include the Debt Avalanche method (paying highest interest first) and the Debt Snowball method (paying smallest balances first), both aimed at optimizing payments or motivation.

How can I reduce my expenses quickly to pay off debt?

You can quickly free up cash by auditing and canceling unused subscriptions, making concrete swaps for variable expenses (like homemade coffee instead of buying out), and following a temporary austerity checklist for 30-90 days.

Is debt consolidation always a good idea?

Debt consolidation is beneficial when it significantly reduces your total interest rate and simplifies payments. However, it’s not always good if fees or a longer loan term increase your total cost, or if you don’t address new spending habits.

Can I negotiate with my creditors for better terms?

Yes, you can prepare documentation and realistic proposals to negotiate with creditors. You can ask for a lower interest rate, smaller monthly payments, or even offer a settlement if you have a lump sum available.

What are common pitfalls to avoid when trying to get out of debt quickly?

A common pitfall is falling back into debt by using cleared credit cards. Also, avoid high-fee quick fixes like payday loans, which often lead to more debt. Focus on sustainable changes and a clear plan.