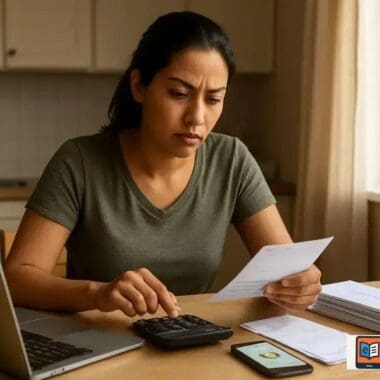

The Ultimate Guide to Budgeting for Single Moms offers actionable strategies for financial stability, teaching you to track every income and expense, smartly cut costs without sacrificing needs, boost income with flexible work and benefits, and build crucial safety nets for a secure future.

Ever feel like your budget is a leaky bucket you can never quite fix? I’ve seen many moms juggle paychecks, school runs, and surprise medical bills while trying to keep the lights on. That pressure is real and it wears you down faster than any single expense.

Studies show nearly 1 in 4 mothers in the U.S. are single caregivers, and research suggests single-parent households face a sizable income gap compared with two-parent families. That’s why The Ultimate Guide to Budgeting for Single Moms matters: it connects practical steps to real constraints and shows where small changes create big relief.

Too many quick-fix budgets ignore childcare costs, irregular income, or the emotional load of parenting alone. Templates that promise instant savings often fail because they don’t reflect unpredictable bills, limited time, or local benefit systems—so people give up before seeing results.

This guide takes a different path. I’ll walk you through a clear diagnosis of your finances, cost-cutting tactics that protect your child’s needs, realistic ways to boost income, and safety-net plans that grow over time. Expect checklists, simple templates you can use tonight, and resource links so you leave with a plan you can actually stick to.

Assess your current finances and set realistic goals

Start with a clear picture: I recommend you map income and outflow before any plan. This makes budgeting honest and doable. Use a simple tool tonight—an app or a spreadsheet.

Track every income and expense for 30 days

Track every transaction for a full 30 days to see real patterns.

Write date, source, amount and a short category. Do it daily or batch once a week so it fits your schedule. Small habits like coffee or subscriptions add up fast.

Example: logging may reveal $50/week on takeout. That is about $200 a month you can reassign to a goal.

Calculate true monthly costs (housing, childcare, food)

Include fixed and variable costs so your monthly total is accurate.

List rent or mortgage, childcare, insurance, utilities, groceries and transport. Add minimum debt payments and typical medical or school fees. For variable items, average recent months to smooth spikes.

Tip: use three months of statements for groceries and utilities, or 12 months if seasonal swings happen. This gives a realistic baseline for essentials.

Set short-term and long-term financial goals

Set specific, time-bound goals so you can measure progress and stay motivated.

Short-term goal examples: build an emergency fund of 3–6 months of essentials or pay off a credit card in six months. Long-term goals include retirement and education savings.

Break goals into small steps. Saving $50 a week becomes about $2,600 a year. Automate transfers and review progress monthly. Celebrate small wins and adjust when needed.

Cut costs smartly without sacrificing your child’s needs

Focus on value, not sacrifice: You can cut costs while keeping what matters for your child. Small swaps and planning save real money without lowering quality of life.

Grocery hacks, meal planning, and bulk strategies

Plan meals and buy bulk to cut grocery bills without skimping on nutrition.

Use a weekly meal plan and shop with a list. Pick store brands, coupons, and frozen produce for savings. Bulk staples – rice, beans, oats – last long and cost less per serving.

Example: cutting takeout once a week and buying bulk basics can free up an extra $50-$200 monthly, depending on family size.

Affordable childcare, swapping, and cooperative solutions

Swap care and share costs through playdate co-ops, childcare swaps, or neighborhood groups.

Organize trusted parents for shared supervision or trade skills – one cooks while another watches kids. Check local libraries and community centers for free programs and low-cost classes.

Tip: track saved hours and money. Small swaps reduce paid-hours and guard routines for kids.

Lower utilities and housing tips that preserve quality of life

Lower bills with small changes like thermostat settings, LED bulbs, and canceling unused subscriptions.

Shop utility plans and negotiate services. Consider modest housing adjustments – seal gaps, use curtains, and switch to energy-saving settings on appliances.

Also, compare housing options carefully. Moving can save money but weigh childcare and commute costs first so quality of life stays strong.

Boost income: side hustles, benefits, and flexible work

Small extra income goes a long way: Focus on flexible options that fit your schedule and can scale over time. Even modest side income can fund savings or pay bills.

Remote and flexible side gigs that fit parenting

Choose gigs that match your hours, like virtual assistance, tutoring, or freelance writing.

Many parents start part-time roles that pay $200–$1,100 monthly depending on hours. Platforms like Upwork and VIPKid let you pick shifts. Start small—test one gig for a month before scaling.

Example: a mom who tutors two evenings a week earned an extra $300 monthly within two months and used that to build an emergency fund.

How to find and apply for government and local benefits

Search benefits early and often—you may qualify for childcare credits, SNAP, or utility assistance.

Check federal and state websites, local community centers, and 2-1-1 hotlines. Gather documents (ID, income proof, bills) before applying to speed approval. Some benefits are backdated, so apply even if you think you’ll miss a deadline.

Tip: many local nonprofits help with applications and can point to emergency grants for single parents.

Practical steps to ask for higher pay or better hours

Prepare a short case showing your value and a clear request for pay or schedule changes.

Track wins and duties, pick a calm time, and propose flexible solutions like remote days or shifted hours. Use market data to support a raise request. If denied, ask for a review in 3–6 months or for non-monetary perks like extra time off.

Even small raises or better hours can increase monthly take-home pay and reduce childcare costs over time.

Build safety nets: emergency fund, debt strategy, and future savings

Protect your family with small, steady steps: Build an emergency cushion, attack debt in a clear order, and put away money for big goals. You don’t need perfect timing—just a plan you follow.

Design a realistic emergency fund plan (small steps)

Start with a $1,000 goal and automate small transfers to grow it over months.

Many experts recommend 3–6 months of essential expenses as the long-term target. If that feels far, save $25–$100 weekly. Automate transfers and use a separate account so the money isn’t easy to spend.

Example: saving $100/month reaches $1,000 in 10 months and builds habit and momentum.

Debt repayment plans: snowball vs. avalanche

Pick the plan you will keep: snowball for wins, avalanche to save interest.

Snowball attacks smallest balances first to build momentum. Avalanche targets highest rates to lower total interest. List debts, interest rates, and minimums. Run a simple calculator to compare time and interest saved.

Real-world tip: combine both—use avalanche on high-rate cards and snowball for low-balance accounts you can clear fast.

Saving for education, retirement, and irregular expenses

Split goals into separate jars so money goes to the right place.

For retirement aim for about 15% of income over time. For education, even modest monthly amounts grow—$200/month at 6% a year becomes a sizable fund in 15–18 years. Keep irregular costs in a basic savings or short-term bond account for easy access.

Automate contributions, review yearly, and prioritize emergency fund first, then debt, then long-term savings.

Conclusion: practical next steps and resources

Take three simple actions today: Start tracking, set one savings goal, and find one local resource or benefit to apply for. Small moves build steady progress.

Gather your notes, pick a single app or spreadsheet, and schedule a weekly 20-minute check-in. That rhythm keeps plans alive and lets you adapt as needs change.

Use trusted local resources like community centers, 2-1-1 hotlines, and nonprofit financial counseling. These often provide free help with benefits, forms, and emergency grants.

Create a brief action list: track 30 days of spending, save one small automatic transfer, and apply for one benefit. Review in 30 days and repeat the cycle.

Keep a short resource list with links to benefits, budgeting tools, and childcare options. Revisit it quarterly and update contacts. Small, repeated steps beat rare big pushes.

Key Takeaways

Navigating single parenthood requires strategic financial planning to ensure long-term security. Here are essential strategies:

- Comprehensive Spending Tracking: Monitor all income and expenses for 30 days to identify spending patterns and uncover potential savings. This foundational step provides clarity on your financial landscape.

- Strategic Cost Reduction: Implement practical savings measures such as meal planning, buying in bulk, and optimizing utility usage. These actions can yield significant monthly savings (e.g., $50-$200) without compromising your child’s well-being.

- Flexible Income Generation: Explore avenues for increasing income, including remote side gigs (tutoring, freelance work) or negotiating for improved pay and hours at your current job. Flexibility is key for single parents.

- Maximize Benefit Utilization: Proactively research and apply for government and local assistance programs for childcare, food, and utilities. These resources are designed to provide crucial support and alleviate financial strain.

- Build a Robust Emergency Fund: Begin with an attainable initial goal, such as $1,000, for your emergency fund. Gradually expand this to cover 3-6 months of essential living expenses, creating a vital financial safety net.

- Systematic Debt Reduction: Choose an effective debt repayment strategy like the debt snowball (paying smallest debts first) or debt avalanche (paying highest-interest debts first) to reduce outstanding balances, save on interest, and move towards financial freedom.

- Prioritize Future Savings: Automate contributions to education and retirement accounts. Consistent, automated savings ensure long-term financial stability for both you and your children, securing their future and your own.

Achieving financial stability as a single parent is a journey built on consistent, intentional actions and effectively leveraging every available resource. By breaking down complex challenges into manageable steps, you can build a secure and prosperous future for your family.

Frequently Asked Questions: Budgeting for Single Moms

How do I start budgeting with limited resources?

Begin simply by tracking all income and expenses for 30 days. Prioritize essential needs like housing, food, and childcare.

What expenses should I prioritize in my budget?

Always prioritize essential needs such as housing, utilities, food, transportation, and childcare to ensure your family’s basic security.

How much should I save for an emergency fund?

Financial experts suggest saving 3-6 months of living expenses. Start with a smaller goal, like $500-$1,000, and build from there.

What are ways to increase my income as a single mom?

Explore flexible side hustles, freelancing, or part-time work that fits your schedule to supplement your primary income.

What’s the best strategy for managing debt?

Create a debt payoff plan that prioritizes debts with the highest interest rates first, to save money on interest over time.

Why is tracking expenses important for single moms?

Tracking expenses proactively throughout the year helps you prepare for predictable costs like holidays and unexpected expenses, preventing financial stress.