How to Get Out of Debt Fast Without a Higher Income

$15.98 Original price was: $15.98.$7.99Current price is: $7.99.

How to Get Out of Debt Fast (Without a Higher Income) is a powerful, step-by-step guide designed for people who are tired of living under financial pressure but don’t have extra income to throw at the problem. This book shows you exactly how to master your money, slash expenses without suffering, and build a fast, personalized payoff plan that works — even on your current salary.

You’ll discover proven techniques like the debt snowball, zero-based budgeting, emotional spending fixes, and income-free ways to speed up your progress. Whether you’re dealing with credit card debt, personal loans, or just want peace of mind, this guide gives you the tools and motivation to take back control.

💡 Real results. Real people. No magic income boost needed.

👉 Tap I WANT TO BUY NOW and start your debt-free journey today.

How to Get Out of Debt Fast (Without a Higher Income) 💸🚫

No Raise? No Problem. Escape the Debt Trap Starting Today.

Are your credit cards maxed out?

Do monthly bills feel heavier than ever?

Tired of hearing the same advice: “Just make more money” — as if it were that simple?

You’re not alone.

Millions are drowning in debt while living paycheck to paycheck, and the reality is: most people can’t just pick up a second job or magically increase their income.

That’s why this eBook exists.

“How to Get Out of Debt Fast (Without a Higher Income)” is your no-fluff, real-world roadmap to becoming debt-free — without relying on more income, luck, or financial jargon.

This guide will walk you step-by-step through how to get control over your money, reduce your debt load faster than you ever thought possible, and create lasting financial freedom… even on your current salary.

🔥 Why This Book Is Different

Most financial advice assumes you have:

- A high-paying job

- A fat savings account

- Plenty of free time

But if you’re overwhelmed, underpaid, and overcommitted — you need a plan that meets you where you are, not where some expert thinks you should be.

This book gives you:

- 🎯 Clear, action-based strategies

- 💡 Smart psychological tactics

- 💵 Real-life budgeting tools

- 🚫 No “get rich quick” hype

💡 What You’ll Learn Inside

This is not theory. It’s a practical, step-by-step playbook built for real people with real bills and real stress.

Here’s a peek at what’s waiting for you:

✅ 1. The Psychology of Debt — And How to Break Free

Learn how debt affects your behavior, confidence, and motivation. You’ll discover:

- Why minimum payments keep you stuck

- The emotional toll of debt shame

- How to shift your mindset from “I’m drowning” to “I’m in charge”

- Proven ways to stop impulse spending and emotional triggers

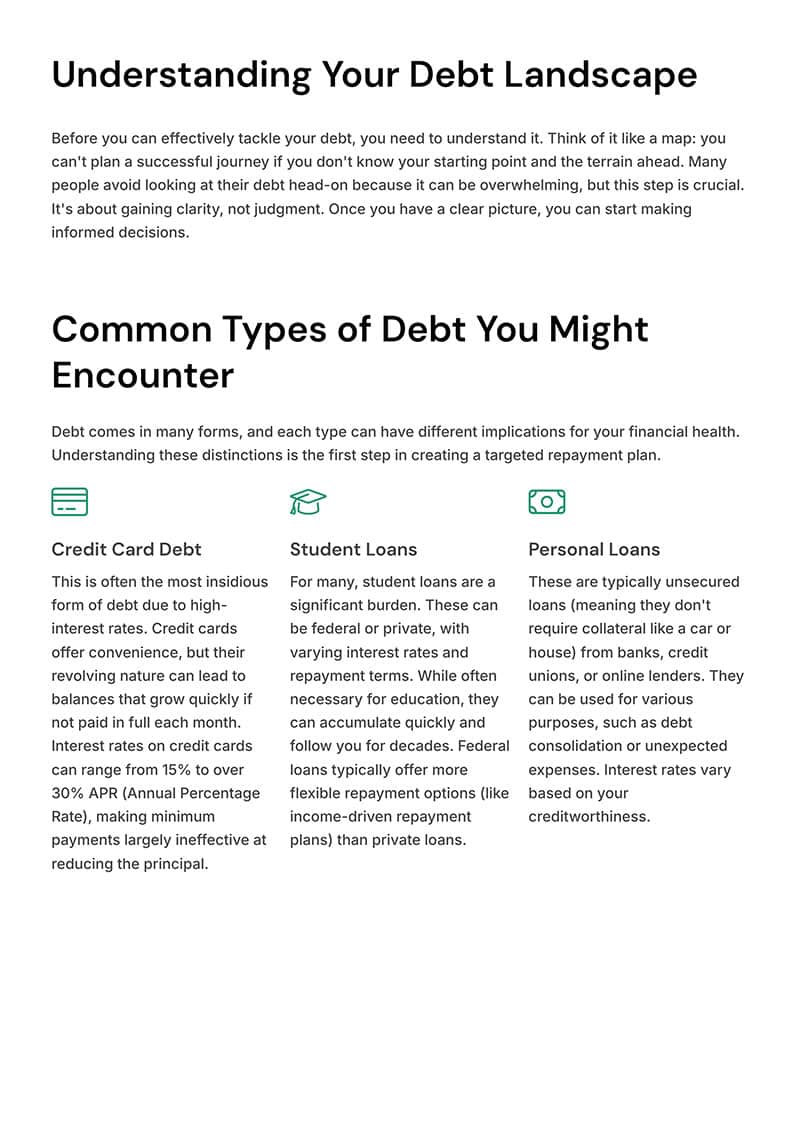

✅ 2. Master Your Budget Without Sacrificing Your Life

Yes, budgeting works — but not the boring way.

This book shows you how to:

- Create a zero-based budget that gives every dollar a job

- Prioritize expenses with a method that feels empowering, not restrictive

- Find hidden money leaks without spreadsheets or stress

- Automate your success (no discipline required!)

✅ 3. Slash Expenses Without Feeling Poor

You’ll learn how to:

- Cut costs on food, subscriptions, insurance, and utilities

- Save hundreds per month — without living like a hermit

- Avoid lifestyle creep and guilt-based spending

- Use the “value spending” method to keep what you love

- Debt payoff doesn’t mean misery. It means clarity.

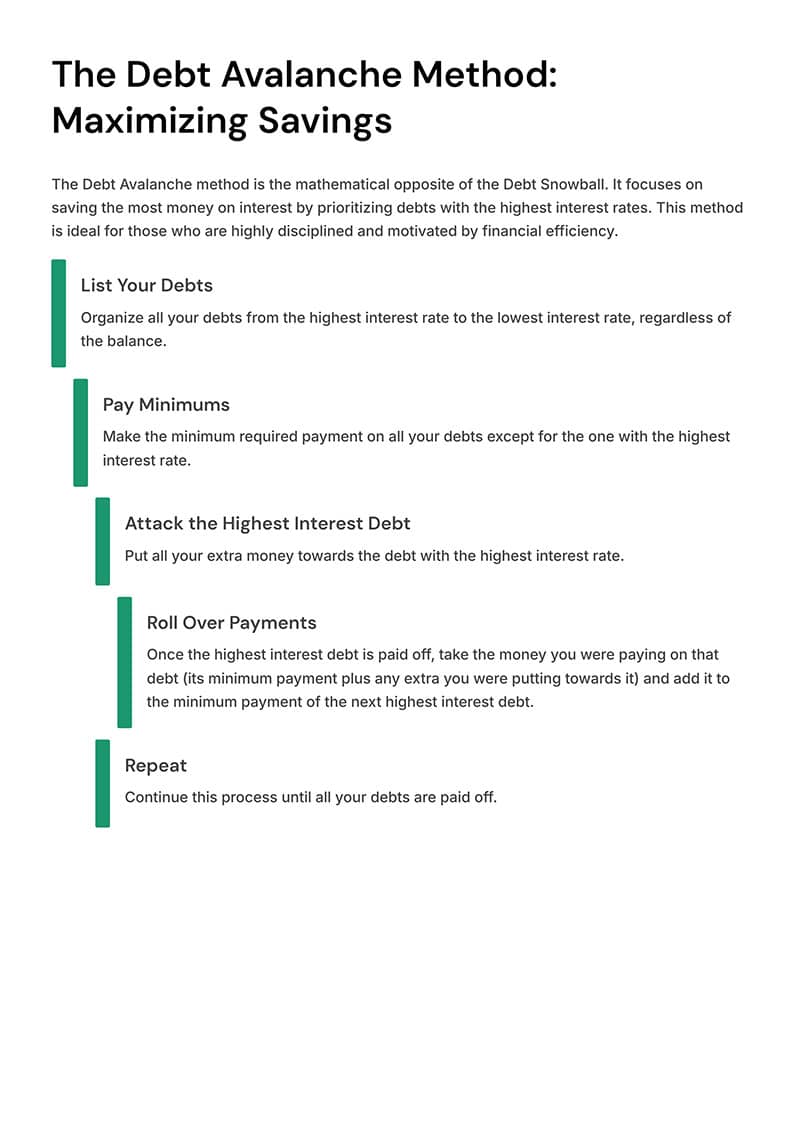

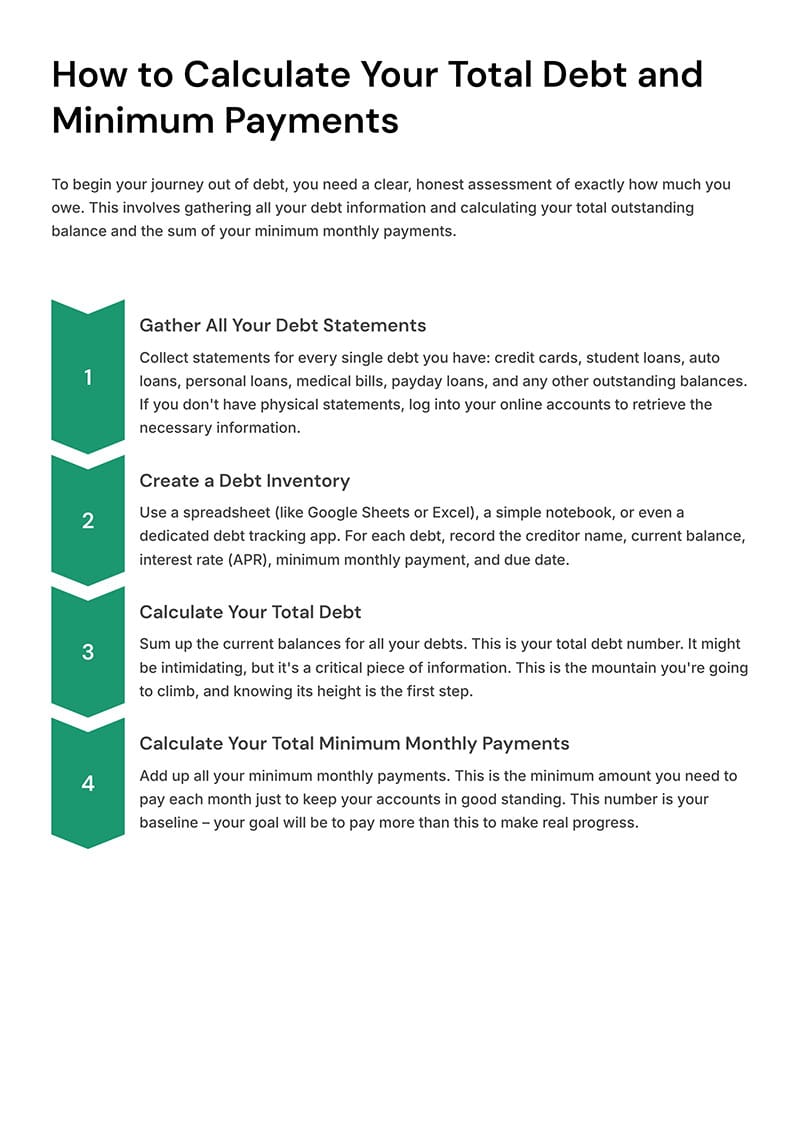

✅ 4. Create a Fast, Personalized Debt Payoff Plan

Inside this section, you’ll:

- Choose between the Snowball and Avalanche method (with guidance)

- Learn how to restructure payments to gain momentum

- Use psychological wins to stay motivated

- Avoid common mistakes that slow you down

You’ll walk away with a real plan — not just vague goals.

✅ 5. Boost Your Paydown Speed (Without Changing Jobs)

No new job? No problem.

This eBook teaches:

- 10+ micro-income streams you can start from home

- How to monetize unused assets or skills

- How to redirect found money (bonuses, refunds, gifts) with intention

- Ways to generate “extra income” inside your current lifestyle

Every dollar you free up is a weapon against debt. Learn how to wield them all.

📉 Debt-Free = Stress-Free (and Science Backs It)

Studies show that financial stress is one of the top causes of:

- Sleepless nights 😫

- Mental health struggles 🧠

- Relationship conflict 💔

- Health issues 😟

Becoming debt-free isn’t just about money — it’s about your peace of mind.

And the strategies in this eBook don’t just save money. They give you back your power.

📦 See a small sample of the eBook below

🙌 Who This Book Is For

- People living paycheck to paycheck

- Parents supporting a household on one income

- Freelancers or entrepreneurs with unpredictable income

- Anyone drowning in credit card or personal loan debt

- Students and young adults who want to start smart

You don’t need to be rich to be debt-free.

You just need the right plan — and this book gives it to you.

⚠️ Why You Shouldn’t Wait

Every day you delay paying off debt:

- Interest builds

- Stress compounds

- Options shrink

But the moment you take action, everything shifts.

Momentum builds. Stress lowers. And freedom becomes visible.

You don’t have to be perfect. You just have to start.

🛒 Are You Ready to Escape the Debt Trap?

👉 Tap Buy Now and get instant access to your roadmap.

No fluff. No guilt. No judgment. Just a clear plan that works — without needing a raise.

You can’t change the past. But you can change your future. Start today.

- 🇺🇸 Language: English

- 📖 38 pages

- 📘 Digital eBook

- ✅ Instant Download

| 5 |

|

1 |

| 4 |

|

0 |

| 3 |

|

0 |

| 2 |

|

0 |

| 1 |

|

0 |

- ADHD focus

- anxiety relief

- attention recovery

- beginner-friendly careers

- break phone addiction

- burnout recovery

- calming exercises

- childhood trauma recovery

- confidence building

- daily rituals

- data entry

- digital detox

- digital nomad

- emotional healing

- emotional resilience

- expat guide

- financial freedom

- flexible income

- focus and productivity

- healing trauma

- life balance

- LinkedIn marketing

- LinkedIn profile optimization

- meditation alternative

- mental clarity

- mindful living

- mindfulness

- no experience jobs

- online jobs

- personal branding

- personal growth

- reclaim time

- remote jobs

- remote work guide

- screen time reduction

- self-care for busy people

- self-love

- smartphone boundaries

- stress relief

- tech-life balance

- time management

- unplug guide

- virtual assistant

- women’s empowerment

- work from home

Related Products

Struggling to budget as a single mom? You’re not alone—and you don’t have to figure it out alone.

The Ultimate Guide to Budgeting for Single Moms is a 179-page PDF designed specifically to help single mothers manage money with clarity and confidence. Inside, you’ll find budgeting templates, savings tips, debt strategies, and emotional support tailored to your real-life challenges.

Whether you live paycheck-to-paycheck or want to plan ahead, this guide gives you the tools to stretch your income, build savings, and feel in control of your finances—without stress or shame.

🎯 Start budgeting with a plan that fits your life.

🛒 Download the eBook now and take your first step toward financial freedom.

Harley Griffiths –

This ebiik is sooo inspiring! Like, who knew that paying off debt could be fun? I’m pumped to try these techniques and see how it goes for me. The idea of creating a zero-based budget sounds interesting! 😍🙌 Let’s break free from the money troubles together!

[...]